nh bonus tax calculator

Below are your federal bonus tax paycheck results. The results are broken up into three sections.

How Is Tax Liability Calculated Common Tax Questions Answered

If your state doesnt have a special supplemental rate see our aggregate bonus calculator.

. NHDRA is accepting applications for its Low and Moderate Income Homeowners Property Tax Relief program through June 30 2021. The maximum an employee will pay in 2021 is 885360. New employers should use 27.

Use the New Hampshire bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method. The current combined Social Security and Medicare tax rate is 765 percent. In NH transfer tax is split in half by buyer and seller.

This tax is not paid directly by the consumer. You will report the bonus as wages on line 1 of Tax Form 1040. This is state-by state compliant for those states who allow the.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. If your state does not have a special supplemental rate you will be forwarded to the aggregate bonus calculator. For multi-state businesses income is apportioned using a weighted sales factor of two and the payroll and property factors.

Use this calculator to help determine your net take-home pay from a company bonus. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. Signing bonus taxes would fall in the above category if received via cash gift. New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202122.

This information may help you analyze your financial. Receive Blog updates via email. Federal Bonus Tax Percent Calculator.

Wage. Federal Bonus Tax Percent Calculator Results. A cash bonus is treated similarly to wages and is taxed as such.

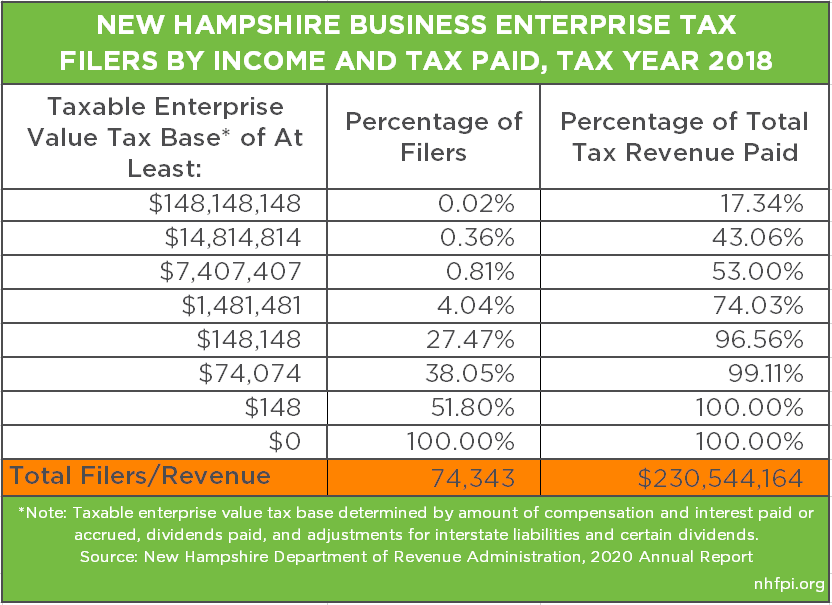

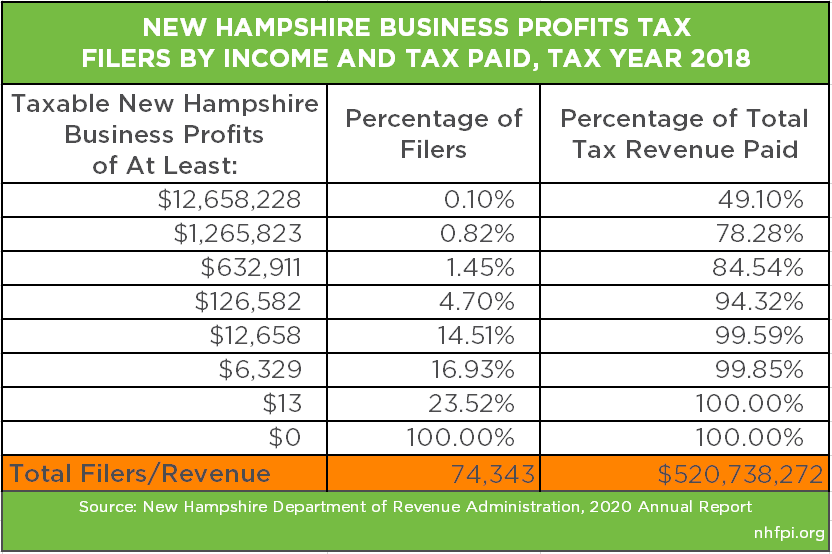

And remember to pay your state unemployment. As the employer you must also match your employees. What is the Business Profits Tax BPT.

For taxable periods ending before December 31 2016 an 85 tax is assessed on income from conducting business activity within the State of New Hampshire. A bonus from your employer is always a good thing however you may want to estimate what you will actually take-home after federal withholding taxes social security taxes and other deductions are taken out. New Hampshire Bonus Tax Percent Calculator Results.

Use the New Hampshire bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method. New Hampshires excise tax on cigarettes totals 178 per pack of 20. The current Social Security tax rate is 62 percent for employees.

With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent. Supports hourly salary income and multiple pay frequencies. On average homeowners in New.

The state has the right to adjust its rates quarterly so look out for notices to make sure you pay the right taxes each quarter. Now is the easiest time to switch your payroll service. 23 days until Jan 1.

State of New Hampshire. NHgov privacy policy accessibility policy. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year.

It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Recently accepted a new job. The results are broken up into three sections.

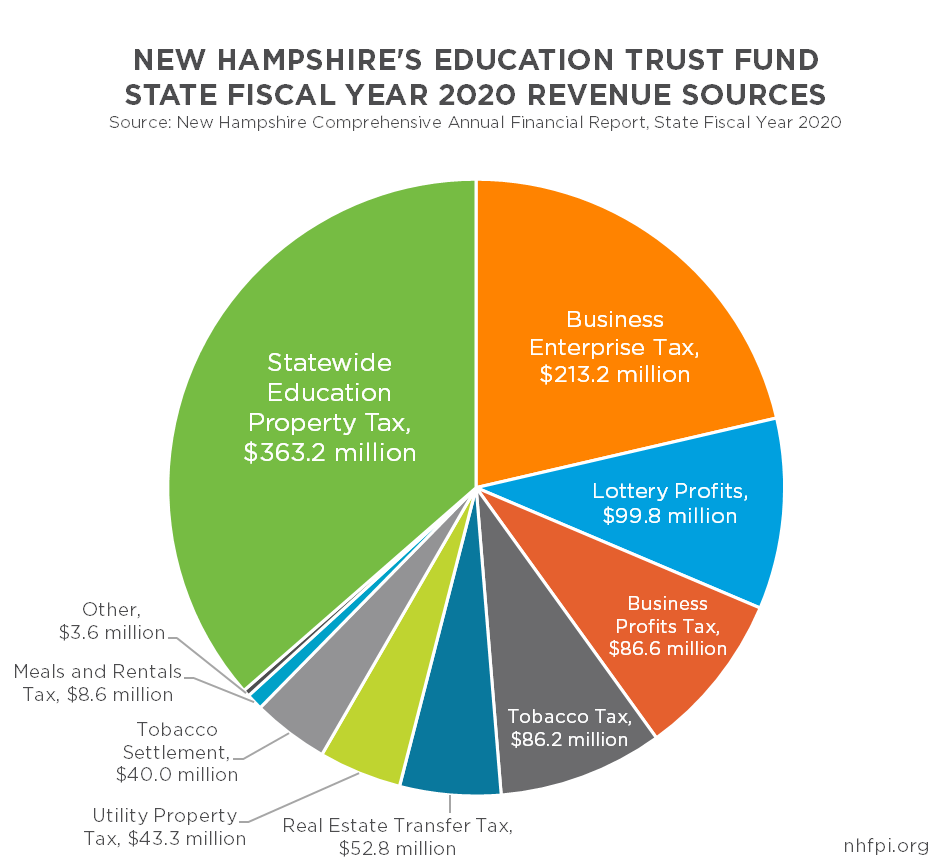

Below are your New Hampshire salary paycheck results. New Hampshire Property Tax. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9.

Social Security is taxed at 62 and Medicare at 145. Withhold 62 of each employees taxable wages until they earn gross pay of 142800 in a given calendar year. This New Hampshire bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

This free easy to use payroll calculator will calculate your take home pay. Or use the expertise of a tax pro to help you do so Signing Bonus Tax. One thing youll notice on your New Hampshire paycheck is deductions for FICA Federal Insurance Contributions Act taxes.

This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. FICA taxes are Social Security and Medicare taxes and they are withheld from each of your paychecks in order for you to pay into these systems.

As the economic recovery continues from the impact of COVID-19 the New Hampshire Department of Revenue Administration NHDRA is offering low and moderate income homeowners the opportunity to apply for property tax relief.

Average Salary In New Hampshire 2022 The Complete Guide

Free New Hampshire Payroll Calculator 2022 Nh Tax Rates Onpay

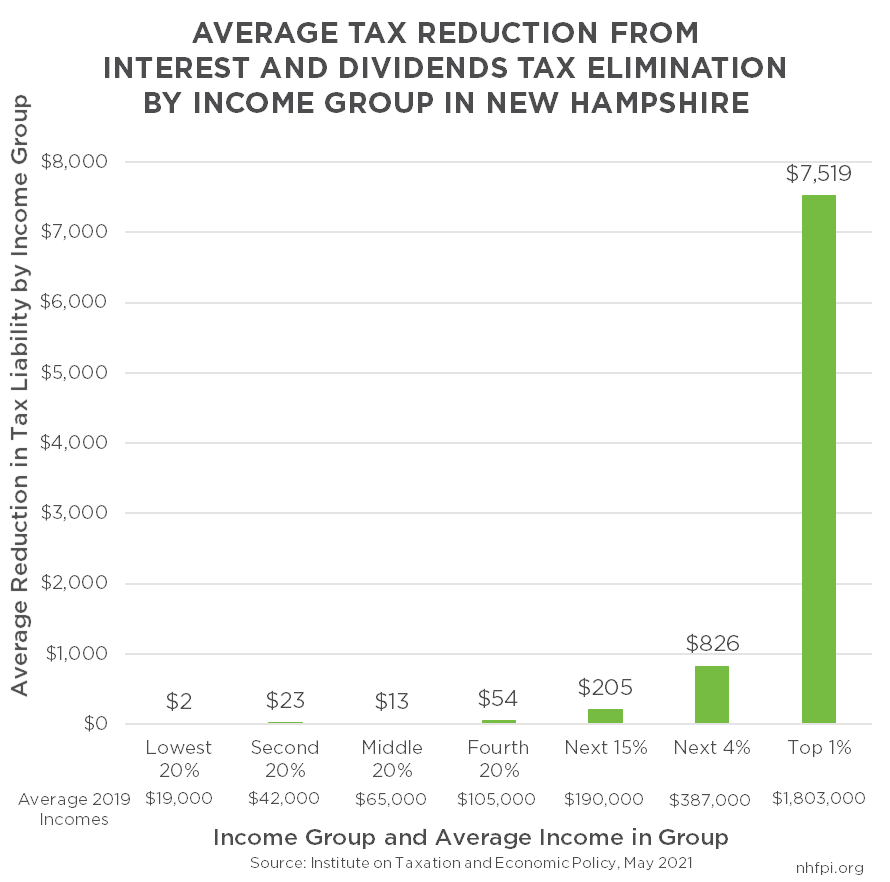

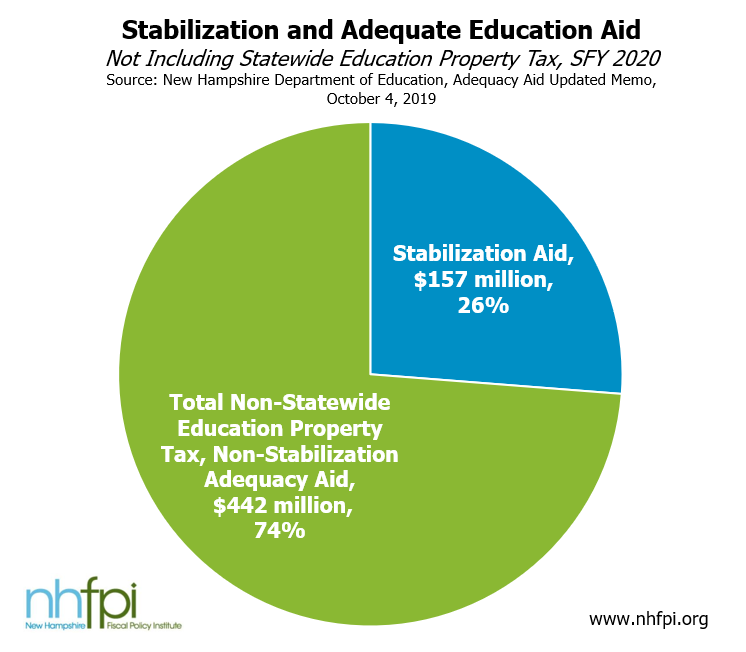

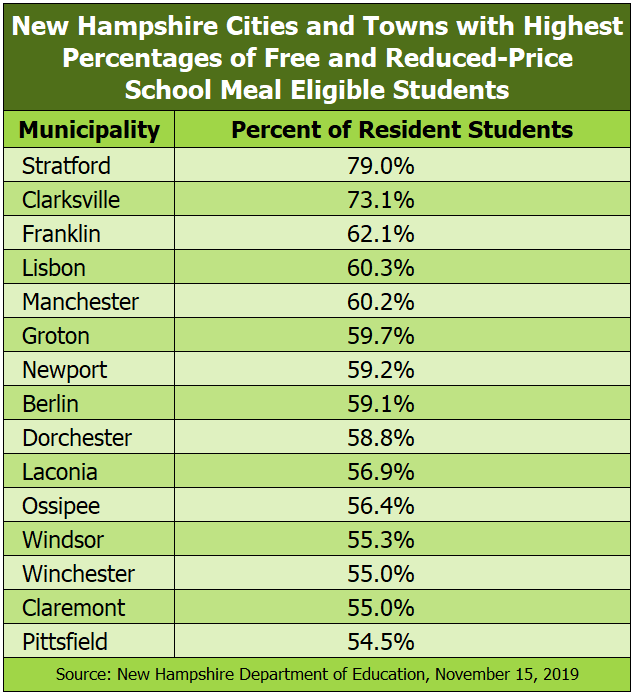

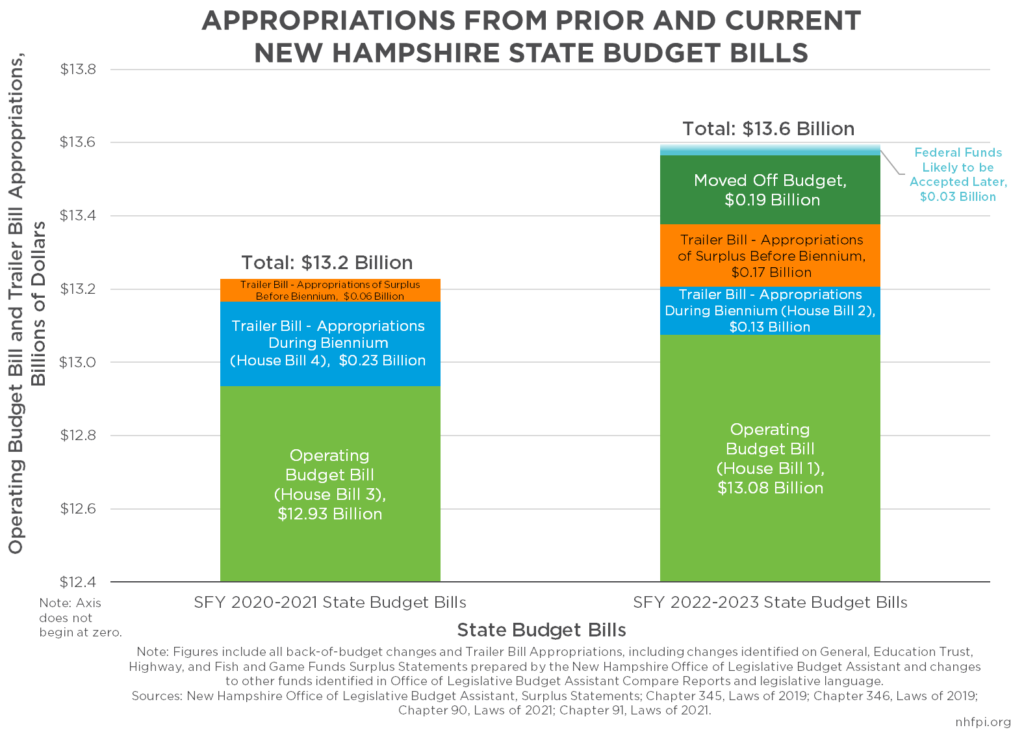

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

New Toyota Cars Trucks Suvs For Sale Near Milford Nh

How Much Does Your State Collect In Sales Taxes Per Capita Sales Tax State Tax Tax

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Trader Securities Salary In Greenland Nh Comparably

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

Only A More Balanced Approach To Public Policies Can Improve Nj S Economy Gsi Garden State Initiative

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

Live In Nh But Work In Ma What To Know About Your State Tax Returns Milestone Financial Planning

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute